If an employer thinks all that a wage and hour violations lead to is simply a monetary fine, think again. In April 2014, U.S. Federal Prosecutors indicted Republican Congressmen Michael Grimm from Staten Island, for violations of wage and hour-related tax laws, and the Immigration Reform and Control Act of 1986 (the “IRCA”), related to a fast food restaurant he once owned. He allegedly filed false state and federal tax returns to underreport more than $1 million in sales and wages by concealing gross receipts and off-the-books cash wage payments.

If an employer thinks all that a wage and hour violations lead to is simply a monetary fine, think again. In April 2014, U.S. Federal Prosecutors indicted Republican Congressmen Michael Grimm from Staten Island, for violations of wage and hour-related tax laws, and the Immigration Reform and Control Act of 1986 (the “IRCA”), related to a fast food restaurant he once owned. He allegedly filed false state and federal tax returns to underreport more than $1 million in sales and wages by concealing gross receipts and off-the-books cash wage payments.

Last fall, the U.S. Labor Department’s Dallas office issued a press release about criminal charges it had levied against a Texas-based rope manufacturer. Not only did the company face criminal charges, but ultimately the “owner, plant manager and office manager were also convicted on separate felony counts” as well.

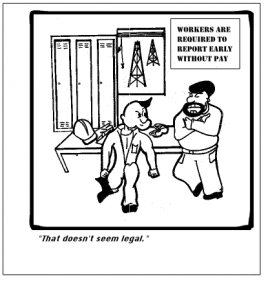

While the majority of FLSA cases involve back-wage payments and various civil penalties, the statute gives the DOL power to levy criminal sanctions, too. Section 16(a) of the FLSA authorizes criminal sanctions against any person who is shown to have violated the FLSA intentionally, deliberately, and voluntarily, or with reckless indifference to or disregard for the law’s requirements. Laws like the IRCA and the FLSA apply not only to business entities but also, as highlighted in the DOL’s press release, directly to business owners, company officers, shareholders, HR managers, supervisors, and even others. Other than a criminal record, the potential penalties include a fine of up to $10,000, imprisonment for up to six months, or both.